National Securities Depository Limited is the full form of NSDL. If you are involved in Stock Market trading or even have a little interest in the Stock Market, you must have come across the word NSDL. It’s also possible that you may have some idea about what is NSDL.

This article will dive deep into the complete details about NSDL and its functioning. I am sure you will learn a lot about NSDL here.

- Founded Year: 8 August 1996

- Head Office: Mumbai

- Product/Service: Depository

- Website: www.nsdl.co.in

Let’s begin!

NSDL- a Basic Idea

National securities depository limited, generally known NSDL is one of the oldest organizations involved in holding and protecting various securities that are traded in the Securities Market.

Concept of NSDL

The concept of NSDL is almost a hundred years old. With Globalization at the beginning of the last century, Stock Market emerged as a critical business sector in the economy of any country. In these markets, bonds, securities, and shares were traded regularly. The trading and storage of these securities were done in a paper form.

This system was flawed at its core. As the number of investors and traders in the country grew, it almost became a nightmare to handle such a massive number of physical certificates. Lots of documents were stored. It was nearly impossible to manage these issues.

To tackle these issues, the Government of India passed the Depositories Act of August 1996. This act laid the foundation of the NSDL in its current form.

Established in August 1996, it is one of the largest depositors in India. The sole purpose of NSDL at the time of the establishment of NSDL was to propel India’s economic development and establish an indigenous security platform with the global standards in India.

Before NSDL was established in India, transactions for all the securities were made through offline mode. This practice was very inefficient and cumbersome. Such a dull process kept ordinary people away from the security trading and Stock Market.

NSDL transformed the way securities were traded in India. After the establishment of NSDL, all trading in securities is done in a dematerialized form. NSDL helps Brokers, Traders, and Investors alike by simplifying the trading process and increasing the efficiency of the Stock Market.

With NSDL, storing, and managing piles of Paper vanished. This improved the efficiency of the staff involved in handling all these documents. Now it’s easy to store and manage any document from any corner of the globe, thanks to NSDL.

Functions of NSDL

NSDL’s functioning is very similar to that of a bank. Banks hold and safeguard the money of its customers, wherein NSDL stores and safeguards the securities of the investors.

NSDL has simplified the process of storing and trading of securities in the electronic form. Before the NSDL, the paper-based process was very inefficient and cumbersome. These traditional methods recorded information about stocks and securities in the paper format. NSDL can be considered as the first step towards the digitization of the Stock Market.

Almost every stockbroker in India prefers NSDL as the safe depository to store their client’s securities, stock, and bonds. Although it is one of the oldest and most trusted organization, you should check on with the brokers about terms and conditions.

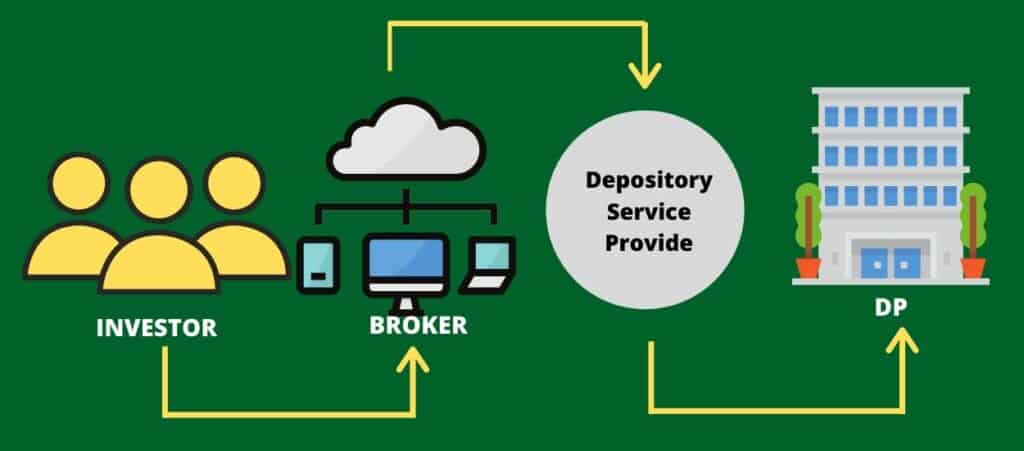

Workflow of NSDL

NSDL is an online platform that offers a safe and secure way of storing stock market-related assets to its customers. Broker, Investors, or Banks who offer various securities to their customers can open their Depository account in NSDL using their DPS.

These Depository accounts can be used by entities offering securities for storing their client’s assets.

NSDL offers three different types of accounts, viz.

- Intermediate Account

- Clearing Member Account

- Beneficiary Account

NSDL basically offers two services under all of the above accounts.

Dematerialization

As the name itself suggests, it’s a process where the hard copies of security certificates of account openers are converted into electronic form. This makes it easy to manage all those documents efficiently.

The process begins with the defacing of the certificate by the broker and submission to the Depository Participant or DP. This DP informs NSDL about the request for the conversion. Those documents are then sent to the issuers who issued them in the first place for the confirmation.

Once the issuers give the confirmation about the certificates, they will inform the same to NSDL.

Finally, after receiving due confirmation from the issuer, NSDL will convert the security into an electronic form. The balance of the certificate is credited to the Depository Accounts.

Re Materialization

This is the exact opposite process of Dematerialization. Under this service, the investor can convert his/her certificates stored in electronic form with NSDL into physical form.

After receiving the request from the investor, the broker informs about the same to the Depository Participant.

This DP or Depository participant informs NSDL about the conversion of electronic certificates and forwards the electronic certificates to the relevant issuer. Once the relevant issuer offers confirmation, NSDL converts the Electronic certificate into a physical certificate.

- SMS alerts:

NSDL offers SMS alerts about all the activities taking place for a certain Demat account holder from its transaction authority.

Consolidated Account Statement

This statement contains all the details of securities and investment held in single or joint accounts in the Market.

These are primary services provided by NSDL to ease the transaction and investment for brokers, traders, and investors. Along with these services, NSDL also offers the following secondary services:

- Market transfers in which securities can be sold are allowed by NSDL

- The inter-depository transfer that allows the transfer of securities from one depository to another depository

- Transmission of shares in cases other than death.

- Various value-added services like hypothecation of securities, automatic delivery out instructions, distribution of dividends, public issues, lending, borrowing, and pledge of securities are also offered by NSDL. These are called corporate actions, and these benefits are given to the investor by the company.

What are the Benefits of NSDL

NSDL is widely accounted organization throughout the nation due to the following reasons:

- NSDL offers the option of instant registration of the securities in online mode. The same process in the pre-NSDL era would take almost two to three months.

- Data is easily accessible to all as all the information is stored in the online mode, unlike in the pre-NSDL era, when every information was stored in the form of Paper

- NSDL has simplified the transfer of securities from buyers to sellers. As the whole process is online, it hardly takes minutes to complete the transfer. In the pre-NSDL era, the same process would take up to two to three months.

- The online process of NSDL has eliminated the possibility of bad delivery. Detailed information of securities is available on with the NSDL, so there are negligible chances of objections.

- Electronic security transfers are exempted from any stamp duty, unlike the physical transfer where compulsory stamp duty is levied.

- NSDL offers the facility for the transfer of bonuses and rights directly to the investor’s account. This simplifies the process of bonuses and the right transfer.

Issues with NSDL

No system is flawless. The same is the case for NSDL. The following are the flaws of NSDL that you must keep in mind.

- NSDL is a fully online platform. So there is no physical verification of the documents. This can result in various frauds and scams.

- Due to numerous privacy breach issues, fraudulent cases of unauthorized transactions are on the rise.

- In India, wee has a multiple depository system. This makes things complicated. Although NSDL has simplified the process of security transfer, many issues need to be addressed.

- Due to multiple depositories in the country, shareholders are bound to pay more and more charges. This happens because every participant charges the investor for holding and safeguarding their account.

- It is impossible to set up a single depository as it’ very impractical and dangerous.

- SEBI does no regulate the NSDL. Due to this reason, it’s prone to manipulation of a powerful individual or a group of powerful individuals.

- Although a lot of brokers and brokerage firms are using NSDL, it’s not mandatory for all.

Also Read: How to Find Top Profitable Companies for Investing

Final Thoughts About NSDL

Surely NSDL has some flaws. But there is no doubt about how it has transformed the Indian Stock Market. It has played a crucial role in putting India on the global platform with its digital nature.

NSDL has simplified the process of trading and investing in securities. This has attracted common people towards the stock market. As more and more people are participating in the Market, the Market is evolving and maturing.

From its inception, NSDL has supported the brokers and traders to manage their securities in an efficient manner.

There is a lot of room for improvement in the functioning of NSDL. And it’s working in the right direction to deliver the best services to the investors and brokers.

I hope all of your doubts about NSDL are cleared after reading this detailed guide on NSDL.

FAQ About NSDL

What is the meaning of NSDL?

National Securities Depository Limited is the meaning of NSDL.

Where is NSDL headquarter located?

Headquarter location in Mumbai, Maharashtra.

Who are the promoters of NSDL?

Industrial Development Bank of India Limited, Unit Trust of India, National Stock Exchange of India Limited are main promoters of NSDL.

Who are the shareholders of NSDL?

Axis Bank, SBI, Oriental Bank of Commerce, Citibank, Standard Chartered Bank, HDFC Bank HSBC Bank India, Deutsche Bank, BOB, Canara Bank are shareholders of NSDL.

What is NSDL payment bank?

Yes, NSDL is payments bank and RBI permitted for the same.

Is it NSDL is the only depository services in India?

No, Till date CSDL and NSDL are depository services provider in India.

What e-services NSDL offers to demat account holders?

IDeAS, NSDL Mobile App, SPEED-e, e-Voting.

Note: In case you have any doubts or want to know more about NSDL, we are here to help! If you need assistance, you can visit us at any time. Just write to us [email protected]

More Useful Article