In this article we will learn about basic of Debt Instruments and its types.

What is Debt Instruments?

The Central Government, State Governments, various corporate bring in certain types of papers for raising capital from the public or from various institutions. It specifies the repayment period and the interest earned on the principal in between. Such papers are called Debt Instruments.

There are different types of Debt Instruments. They are as follows.

- Bonds

- Certificates of Deposit

- Commercial Papers

- Debentures

- FDS

- G-Secs (Government Securities)

- National Savings Certificates (NSC)

Debit Market for Debt Instruments ET is a subject of extensive deliberation and complexity. However, to get acquainted with Debt Fund, we will try to get the information of Debt Instruments.

Bonds

Through this tool, government or corporate companies raise money from the public for raising capital. The maturity date and the coupon rate are pre-determined. Bonds are secured.

List of profitable Bonds In India

| Bond Name | Coupon | Maturity | Rating | Interest Payment | Yield | Price ₹ |

|---|---|---|---|---|---|---|

| Asirvad Micro Finance | 11.90% | Jun-26 | CRISIL AA- | Monthly | 11.50% | 1,03,868 |

| Svatantra Microfin | 12.90% | Sep-26 | CRISIL A+ | Annually | 11.25% | 10,75,193 |

| The Karur Vysya Bank | 11.95% | Jun-29 | ICRA A | Annually | 10.25% | 1,05,532 |

| Kogta Financial | 10.95% | Sep-22 | CARE A- | Monthly | 10.00% | 71,511 |

| Belstar Microfinance | 10.50% | Sep-22 | CARE A+ | Quarterly | 9.50% | 8,76,247 |

Certificates of Deposit (CD)

Certificates are marketed by commercial banks and financial institutions permitted by the Reserve Bank. Their maturity is shorter and the interest rate is slightly higher than the savings account.

Top 5 CD’s of India with higher number of Unit Settle.

| Banks/FI | Average Yields |

|---|---|

| Axis Bank Limited | 7 |

| Idfc Bank Limited | 6.84 |

| Indusind Bank Limited | 7.17 |

| Hdfc Bank Limited | 7.07 |

| Icici Bank Limited | 6.93 |

Commercial Papers

Companies market these papers to meet their short-term financial needs. They have a premature period of 7 days to 1 year. They are Unsecured as they have no collateral support.

Debentures

Government and corporate companies raise money through Debentures for long-term capital raising. Their maturity is usually more than 10 years, they are also unsecured due to lack of Nlateral support but their interest rate is fixed.

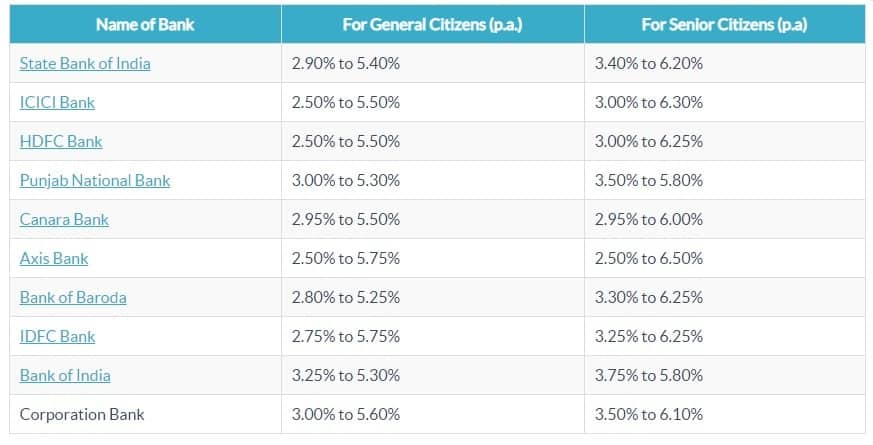

FDS

FD or term deposit is the most popular type of investment. Banks and NBFCS raise capital through FDs.

G-Secs (Government Securities)

Central and state governments raise bond capital to meet their short-term and long-term financial needs. Their maturity period and interest rate are fixed. They are very safe as they are marketed by the government. G-Sec is the hub of the country’s overall debt market. They fall into several subtypes depending on their maturity.

National Savings Certificates (NSC)

- It is the most preferred investment tool of the middle and lower middle class. It is distributed by the Central Government through the Indian Post Department. Investments in these are exempt from income tax under 80C.

- All the above Debt Instruments are brought to the market by the Government of India, various State Governments, Banks, Corporate Companies and thereby raise capital for different periods.

- You may have always read or heard that investors who do not want to risk, senior citizens and retirees should prefer debt funds over equity funds. Because they have no market risk. That is, they do not invest in the stock market. However, Debt Funds or Debt Instruments other than G-Sec have two risks: Credit Risk and Interest Risk.

- Credit Risk is the risk of lowering the credit or financial performance of a company launching Debt Instruments and Interest Risk is the risk of lowering the market value of Debt Instruments if the Reserve Bank raises interest rates.

Conclusion

Because of this, when investing in debt funds, the portfolio of the fund, the reputation of the fund manager and the grading of the credit rating companies have to be examined very carefully.

Take a Look