UTI AMC IPO offer by UTI Asset Management Company Private Limited and UTI AMC is a India’s 4th largest asset management company founded under Unit Trust of India Act 1963, UTI Repeal Act 2002. Headquarters located in Mumbai, Maharashtra and one of the biggest company related to Mutual fund Industry.

UTI AMC currently served globally. Area served like India, Japan, Singapore, London, Dubai and Bahrain. Mainly company deals in service like Portfolio Management Services (PMS) and product like Mutual Funds, National Pension System, Private Equity, Private Debt.

UTI Asset Management Company, UTI International Limited, UTI Ventures, UTI Retirement Solutions, UTI Capital are Subsidiaries of company.

UTI AMC dilutes 8.25% stake in UTI MF through IPO On December 4, 2019. Huge distribution center includes 163 UTI Financial Centers,Total 79 OPAs, 273 BDAs, 51,000 IFAs.

Key Points

- SBI, LIC, BOB, PNB are 4 Financial Institutions sponsors and each one has major share holding by government of India.

- TRP has 26% stake in company and TRP is globally major player in Asset management.

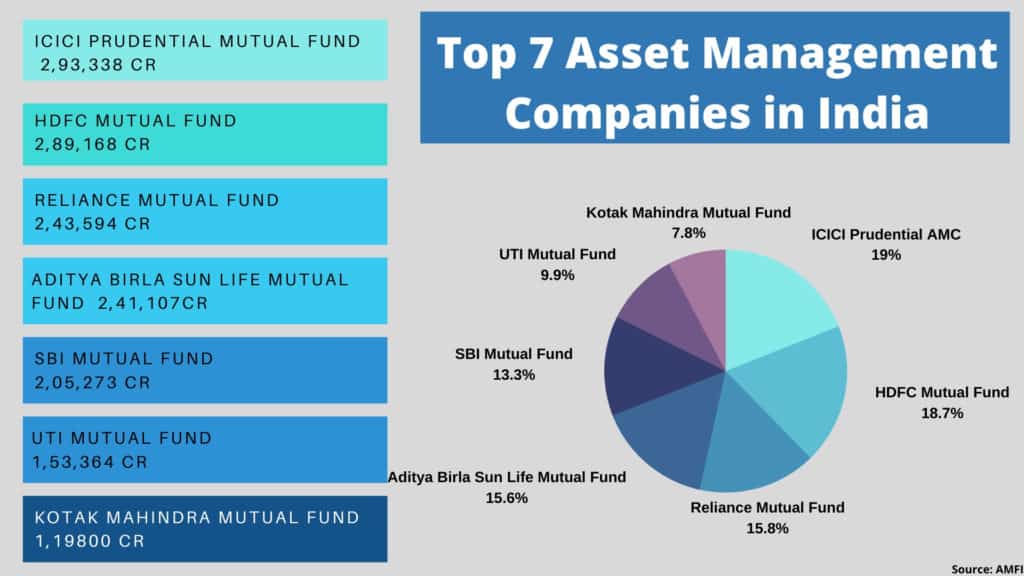

- India’s One of the largest Asset management company.

- large Distribution channel.

UTI AMC IPO Issue Details

| Issue | Details |

|---|---|

| Name | UTIAMC |

| Issue Opens | 2020 |

| Issue Closes | 2020 |

| Exchange | NSE, BSE |

| Issue Size (crore) | ₹ [●] |

| Fresh Issue | 38,987,081 shares |

| Price Band | ₹ [●] to ₹ [●] |

| Face Book Value | ₹ 10 each equity shares |

| No. of shares on offer (crore) | 38,987,081 shares |

| QIB (%) | |

| Retail (%) | |

| Minimum Lot Size | |

| Maximum Lot Size | |

| Employee | UP to 200,000 equity shares reserved for eligible employee |

| Offer Type | 100% Book Built Offer |

UTI AMC IPO Issue Size

| Issue | Up to 38,987,081 Equity Shares |

| Offer for sale though below 5 companies | |

| Sale offer by SBI | UP to 10,459,949 Equity Shares |

| Sale offer by LIC | Up to 10,459,949 Equity Share |

| Sale offer by Bank of Baroda | Up to 10,459,949 Equity Share |

| Sale offer by PNB | Up to 3,803,617 Equity Share |

| Sale offer by TRP | Up to 3,803,617 Equity Share |

| Employee Reservation Portion | Up to 200,000 Equity Shares |

Shareholding Pattern (%)

| Pre-Issue | Post-Issue | |

|---|---|---|

| Promoter Group | 100.0% | |

| Public/Other | 0.0 |

UTI AMC Financial Details (INR ₹ Million,)

| (in ₹ million) | FY17 | FY18 | FY19 | H1 FY2020 |

|---|---|---|---|---|

| Equity Share Capital | 1,267.87 | 1,267.87 | 1,267.87 | 1,267.87 |

| Net worth | 20,260.04 | 23,674.33 | 26,043.72 | 27,111.98 |

| Total Revenue | 10,349.31 | 11,500.52 | 3,528.31 | 4,740.34 |

| Profit / (loss) | 4,003.11 | 3,642.05 | 3.43 | 2,089.98 |

| Net asset value per Equity Share (in ₹) | 159.80 | 186.43 | 205.41 | 213.84 |

| Earnings Per Shares Basic (in ₹) Diluted (in ₹) | 31.57 31.57 | 28.73 28.73 | 27.83 27.83 | 16.48 16.48 |

UTI AMC Company Contact Information

| Contact Details | Registrar |

|---|---|

| UTI Asset Management Company Private Limited UTI Tower, ‘Gn’ Block, Bandra-Kurla Complex Bandra (East), Mumbai 400051, Maharashtra, | KFin Technologies Private Limited Selenium Tower-B, Plot 31 & 32, GachibowliFinancial District, Nanakramguda, Serilingampally Hyderabad 500 032, Telangana, India |

| Phone: +91 22 6678 6666 | Phone: +91 40 6716 2222 |

| Email: [email protected] | Email: [email protected] Investor grievance: irfc.ipo@kfintech. |

| Website: www.utimf.com | Website: www.kfintech.com |

UTI AMC IPO Allotment Status

- IPO Opening Date: Not Yet Announced.

- IPO Closing Date: Not Yet Announced.

- Final Allotment: Not Yet Announced.

- Refunds: Not Yet Announced.

- Transfer of shares to Demat accounts: Not Yet Announced.

- Share Credit to Demat Account: Not Yet Announced.

Listing Day UTI AMC Performance.

| NSE | BSE | |

| Listing Date | 2020 | 2020 |

| IPO Price | ₹ [●] | ₹ [●] |

| Open | ₹ [●] | ₹ [●] |

| High | ₹ [●] | ₹ [●] |

| low | ₹ [●] | ₹ [●] |

| Close | ₹ [●] | ₹ [●] |

| Volume | ||

| Listing Day P/L |

Analyst Reviews.

Subscription Details

| Category | Offered Shares | DAY 1 | DAY 2 | DAY 3 | DAY 4 |

|---|---|---|---|---|---|

| QIB | |||||

| NII | |||||

| Retail | |||||

| Total |

UTI AMC IPO Lead Managers

| Kotak Mahindra Capital Company Limited | ICICI Securities Limited |

| Axis Capital Limited | JM Financial Limited |

| Citigroup Global Markets India Private Limited | SBI Capital Markets Limited |

| DSP Merrill Lynch Limited |

Company Promoters and Boards of Directors

| Designation | Name |

|---|---|

| Non-Executive Chairman | Dinesh Kumar Mehrotra |

| Chief Executive Officer | Imtaiyazur Rahman |

| Non-Executive Director | Edward Cage Bernard Flemming Madsen |

| Independent Director | Ashok Shah Deepak Kumar Chatterjee Dipali H Sheth Jayashree Vaidhyanathan Narasimhan Seshadri Rajeev Kakar Uttara Dasgupta |

FAQs for UTI AMC IPO

What is UTI AMC IPO?

This IPO offer by UTI Asset Management Company Private Limited. company planning to expand capital by listing on NSE and BSE.

How do I apply for the UTI AMC IPO?

Anyone having demat account are eligible for application. There are two method available for application.

ASBA Payment Method : The net-banking facility available for online IPO application.

UPI Payment Method: By using UPI payment method for application process.

What is the UTI AMC IPO issue date?

UTI AMC IPO issue period is from [●] to [●].

What is the UTI AMC IPO allotment date?

Allotment date is [●] and share will transfer to your demat account on (*).

What if UTI AMC IPO Shares not allotted to me?

Suppose UTI AMC shares not allotted to you than refund will be credited to your linked bank account.

How to Apply UTI AMC IPO through Zerodha?

Zerodha customers can apply for UTI AMC through UPI’s payment gateway by Zerodha Console. Pls follow Below steps.

login to console.zerodha.com

Portfolio<<IPOs

Get the list of current listed IPOs.

You can apply for an IPO online.

What is the UTI AMC IPO Listing date?

Listing date for this IPO is [●].

Is there any other UTI AMC IPO Listing later this year?

There is no such information available regarding the further listing of State bank of India IPO.

Will I get a discount if I am UTI AMC Employee?

Up to 2,00,000 Equity shares reserved for eligible employee. Discount not yet announced

What is the Lot Size of UTI AMC IPO?

Minimum [●] shares (1 lot) and maximum [●] shares of lot size is available. One share price is ₹.[●] so 1 lot of [●] shares will be ₹.[●].

What is the face value of UTI AMC IPO?

Face value is ₹.10 Per Equity Share.

What UTI AMC IPO symbols in NSE & BSE?

NSE: UTIAMC & BSE: [●], Group: [●]

Also Read: