Most famous world’s greatest investors of all times are John Bogle, Warren Buffett, Philip Fisher, Benjamin Graham, Peter Lynch Investment is a art to increased your financial wealth. These 5 people can be a role model for every trader who invests in the stock market.

John Bogle – 1st World’s Greatest Investors

- Net worth: US $190 Million

John Bogle was born in 1929 in Montclair, New Jersey. He graduated from Princeton University in 1951 with a degree in economics. From 1951 to 1974, he worked as a financial advisor at Wellington Management, from where he acquired the investment management business knowledge.

In 1974 he founded the Vanguard Group Mutual Fund Company. He later became its CEO and later became its chairman. He retired in 1999.

Bogle was the first to establish a no-load mutual fund and also taught the concept of low-cost index investing to millions of investors. In 1999, Fortune Magazine named Bogle the “Investment Giant” of the twentieth century.

Investment Style

Jack Bogle investment philosophy was to capture market capitalization by investing in Broad Base Index Mutual Funds with no-load, low-cost, low-turnover and passive management. Indicates that individual investors should focus on the next point.

- Reducing the cost associated with investment and reduce expenses.

- By studying the productive economics of long-term investment horizons.

- Believing in wise or proper analysis and controlling your mind when making investment decisions. An individual investor should use the right index investing strategy.

Warren Buffett – 2nd World’s Greatest Investors

- Net worth: US $ 81 Billion

Warren Buffett is one of the most successful investors in history. Using the theory developed by Benjamin Graham, Warren Buffett invested in stocks and also bought several other companies through Berkshire Hathaway and made huge profits of billions of dollars.

Early Life

Warren Buffett was born in 1930 in Omaha, Nebraska. He graduated from the University of Nebraska in 1950 with a degree in science. After reading Benjamin Graham’s book, The Intelligent Investor, he became interested in learning more from Buffett and Graham

He later founded an investment firm, Buffett Folk & Company, and worked as an investment salesman for the company from 1951 to 1954. It was during this period that Buffett established a very good relationship with Graham.

This led to Buffett getting a job at Graham’s New York firm, Graham-Newman Corporation, where he worked as a security analyst from 1954 to 1956, working under Graham and analyzing hundreds of companies. Wanting to work independently,

1st Investment

He started a traditional investment partnership at the age of 25 with an initial capital of $100,000. The company, which started in 1956, closed down in 1969, during which time Buffett himself and other investors made more than 30 times the profit per share.

Investment Journey

Prior to dissolving the partnership, Buffett bought Berkshire Hathaway Textiles, an unprofitable company, in 1965. After acquiring Berkshire, Buffett turned the company’s successful turnaround into a profit. Buffett later invested in other companies through this company.

The market collapsed completely in 1973-1974. At the time, the Berkshire Company had a golden opportunity to buy other companies at the price of water .So Buffett began buying the company immediately. It also includes the Washington Post.

What happened next is a historic event, and Berkshire is now a huge holding company. Over the last two thousand and six years, the total estimated value of all its business assets and sales has reached 240 billion and 100 billion, respectively. In 2006, Buffett announced donation of 34 billion stock holding for the Bill & Melinda Gate Foundation and four other charities (6 billion).

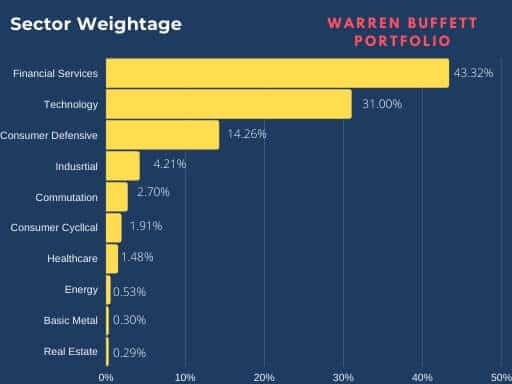

Investment style

He has rules the investment world for long times with discipline, patience and value.

Buffett said many times that many businesses are sold because they don’t understand their value. When that happens, buy them boldly, regardless of the current bad situation in the economy and the predictions in the stock market.

Buffett criteria for “Wonderful Business” include the following.

- They should be able to get a good return on their capital without incurring too much debt.

- Be sensible.

- They should be able to see the profit in their cash flow.

- Their citizenship should be strong.

- They do not need any other talented people to travel.Their earning must be planned in advance.

- Their management should be owner oriented.

Philip Fisher – 3rd World’s Greatest Investors

- Net worth, US $ 4.4 Billion

Philip Fisher was born in 1960 in San Francisco, California. After graduating from Stanford Business School in 1928, Fischer began working as a security analyst at a bank in Anglo-London, San Francisco.

He then worked for a stock exchange firm for some time. And then in 1931 and started his own money management business called Fisher & Company. He retired from the company in 1999 at the age of 91. During his tenure at the company, Fisher made huge profits for his clients.

Investment style

Philip Fisher has a long history of investing in a well-managed high quality growth company and has a track record in money management over a period of seventy years.

For example: he bought the stock from Motorola in 1955 and did not sell it in 2004 and until his death.

- Fisher’s well-known issues, which should also be looked at in general stock, are divided into two categories.

- Management Quality and Characteristic of Business. Key traits in management include honesty, conservatism, accounting, accessibility, and the openness required to bring about good long-term outlook change, as well as better financial control and better personal policies.

- Key Business Characteristics Growth Orientation High Profit Margin Endurance Compensation Capital Research and Development Commitment, Superior Sales Organization, Leading Industry Position and Priority Products or Services.

Philip Fisher did in-depth and extensive research to get company information. Fisher used all his contacts to get information about the company. His method of analyzing company information was invaluable.

Benjamin Graham – 4th World’s Greatest Investors

- Net worth: US $ 25.1 Billion

Benjamin Graham was born in London in 1894 and arrived in the US in 1985, a year later. He grew up in Manhattan and Brooklyn, New York. His father died when Graham was nine years old. As a result, the financial situation of their home deteriorated. He graduated from Columbia University in 1914. He then immediately started working at Wall Street ‘Farm New Burger Henderson and Lomb and then in 1920 he became a partner in that firm’.

In 1926, Graham formed an investment partnership with Jerome Newman and began lecturing on finance in Colombia. He continued this work till his retirement in 1956. In 1929, the planet was plunged into the stock market. Only their investment partnership was close and then with her help they gradually came to its previous position.

From this experience Graham learned some valuable lessons and then in 1934 he wrote a book called Security Analysis which became the basis of investment. Much progress was made in Graham’s partnership. The company’s average annual return was 17%. And that continued until the company closed in 1956.

The two books written by Graham, “Security Analysis” (1934) and “The Intelligence Inventor” (1949), were considered the best books to guide investors in the stock market.

Investment style

- Ben Graham believed in the company’s method of thorough analysis. Which we call fundamental analysis. Companies with strong balance sheets or low debt rates, higher than average profit margins and high cash flows were looking for it.

- Graham was looking for companies whose stock prices may have been low for some time, but whose long-term fundamentals would be good.

Graham believed that market valuation could be wrong at times. His philosophy was that this feature of the market gave investors the opportunity to buy when prices plummeted and to sell properly if they got a great deal.

Peter Lynch – 5th World’s Greatest Investors

- Net Worth: US $ 350 Million

Peter Lynch was born in 1944 in Newton, Manchester. He graduated from Boston College in 1965 with a degree in Finance. He then served in the military for two years. And in 1968 received a Master of Business Administration from the University of Pennsylvania.

He worked as an analyst at Fidelity Investments and later became the research director of his firm, a position he held from 1974 to 1977. In 1977, Lynch became the manager of the Magnificent Fund.

He held the post for 13 years after that. And in these 11 years of thirteen years, they have surpassed the S&P Index benchmark with 29 annual average returns. In 2007, Peter Lynch became Vice Chairman of Fidelity Advisory Fidelity Management and Research Company.

Investment style

Peter Lynch always used the following eight fundamental principals in the process of selecting his stock.

He has also published several books. One Up on Wall Street and Boating the Street, his books are a must read for investors.

- You just have to be more discriminating with the help you render toward other people.

- It is useless to make predictions about the economy and the door of interest.

- You should have enough time to identify exceptional companies and learn more about them.

- Avoid long shots.

- Good management is very important.

- Choose a good business.

- Maintain flexibility and humility in practice and learn from past mistakes.

- Before you buy, you need to know why you are doing it.

Also Read: How to Select Shares for Portfolio Investments

More Useful Article

Hi do you have to pay for signal and do you have to pay to get your profits to be deposited into your bank acc