Just Trade Securities, the recently launched Online Investment & Financial Services company of Bajaj Capital, is an extension of the groups highly valued expertise as the most preferred financial advisoryfirm in India. The service (www.justtrade.in) went LIVE on 03rd January 2008 & is aimed at Wealth Creation for the working professionals, business owners, experienced investors & beginners.

There are no speed limits for creating wealth. Our hi-tech & highly reliable online connectivity through V-SAT & Lease Lines ensures that your trading orders are executed at lightning speed.

Some of the key highlights of an investors A/c apart from providing a Transaction Platform across Trading, Mutual Funds & IPOs include Investment Services- For any kind of investment related queries, the client will have access to his relationship manager.

The Relationship Manager will facilitate informed decision making on the part of the investor (with respect to his investments & overall management of his financial matters) by sharing his Plan, Product & Research Expertise with the client. Investment Services can be availed Online OR through Voice Based Platform or Over the Counter from select branch centers

| Website. | www.justtrade.in |

| Demat Account. | CDSL/NSDL. |

| Trading Exchanges. | NSE, BSE, MCX & NCDEX. |

| Broker Type. | Full Service Broker. |

Just Trade Securities pros and cons

Broker has low fees, as compare to other full service brokers. The desktop trading platform, web trading platform, Mobile Trading App are easy to use and technically well-designed. they provide quality research.

| Pros | Cons |

|---|---|

| Low Brokerage fees compare to other full-service broker. | No investor Protection |

| Good Trading Platform | High Account Opening Fees compare to other full-service broker. |

| Solid Research |

Main features and highlights

- Exchange Enable: NSE, BSE, MCX, NCDEX

- Trading Fees: Low

- Inactivity Fee Charged: No

- Withdrawal Charges: No Idea

- Minimum Deposit Required: Rs. 10 000/- for basic plan.

- Time to open an Account: Max 5 Days

- Products offered: Stock, Currency, Options, Futures

Just Trade Securities Account Opening Fees

Justtrade.in provides 3 different kind of online trading (Basic, Basic plus, Platinum) to their investors. Also provides free call & Trade facilities, Phone a Fund that gives direct access to Relationship Manager & Equity Advisory Team’.

Basic Plan

Account opening fees are higher than other. They charges Rs.599 for Trading account opening and Rs.599 form trading account Annual maintenance charges but Demat Account opening is absolutely free and Demat Annual maintenance charges is Rs 250 per year.

| Trading Account Opening Fee. | Rs 599 |

| Trading AMC | Rs 599 |

| Demat Account Opening Fees | Rs.0 |

| Demat account. | Rs 250 PA |

| Provide DP Service | Yes |

| Margin Money Requirement | Rs. 10,000/- |

Basic Plus & Platinum

| Plan | Basic Plus | Platinum |

|---|---|---|

| Account Activation Charges | Rs.1499 + Taxes | Rs.2499 + Taxes |

| Account Activation Amount | Rs.1769 | Rs.2949 |

| Margin Money Requirement | Rs. 25,000/- | Rs. 50,000/- |

What is the Minimum Deposit at Just Trade?

Required minimum deposit of Rs.10,000 for basic, Rs.25,000 for basic plus and Rs.50,000 for platinum account, there is an Rs.599, Rs.1499 and Rs.2499 for basic, basic plus, platinum account opening fees demat and trading account.

Account types

There are two account types available:

- Demat & Trading account – for equity and currency trading

How to open your account

The opening process done as per sebi regulation. Required 5 days for account opening after all the documents approved. Required necessary documents for account opening.

Documents required for account opening:

- Correct email address.

- Photograph

- Enter your PAN number (Permanent Account Number)

- Bank statements.

- Address proof

- Bank Cancelled Cheque.

Just Trade Securities Trading Brokerage Charges.

Just Trade offers brokerages plan like Basic, Basic Plus, Platinum.

Basic Brokerage Plan

| Name | Basic Trading Plan |

|---|---|

| Equity Delivery | 0.4% or 40 paisa |

| Equity Intraday | 0.04% or 4 paisa |

| Equity Futures | 0.04% or 4 paisa |

| Equity Options | Rs 50 Per Lot |

| Currency Futures | 0.04% or 4 paisa |

| Currency Options | Rs 50 Per Lot |

| Commodity Trading | NA |

| Toll Free Support | Yes |

| Call-N-Trade | Free |

| Demat Account AMC | 1st year free |

Non-Trading Fees

Just Trade has low non-trading fees. They charges account fees bet no fees for account deactivation.

- The fee is INR 599 for Basic Account activation and it is best for retails Investors

- The fee is Rs.1499 for Basic plus Account activation and it is best for MNI Investors

- The fee is Rs. 2499 for Platinum Account activation and it is best for MNI Investors

| Just Trade | |

|---|---|

| Account Fee | Yes |

| Inactivity Fee | No |

| Deposit Fee | no |

| Withdrawal Fee | NA |

Just Trade Securities Transaction Charges

There are other fees, like SEBI charges, taxes beyond the brokerage fees.

| Segments | Transaction Charges |

|---|---|

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00295% |

| Equity Options | 0.00295% |

| Currency Futures | 0.00295% |

| Currency Options | 0.00295% |

Web Trading Platform

Just Trade web trading platform has a simple and easy design, and user-friendly.

Advantages of web trading platform

- User-friendly

- Good search function

- Fast and Secure

Web Platform Look

Just Trade Platforms Ratings

| Trading Platform | Score | Available |

|---|---|---|

| Web | 3.8 / 5 stars | Yes |

| Mobile | 4.5 / 5 stars | Yes |

| Desktop | 4.5 / 5 stars | Yes |

Alerts and Notifications

Notifications and Alerts are available. Traders can set alerts for intraday prices, Changes, etc.

Portfolio and Reports

Just trade provide reports and portfolio. Every thing is available in backoffice.

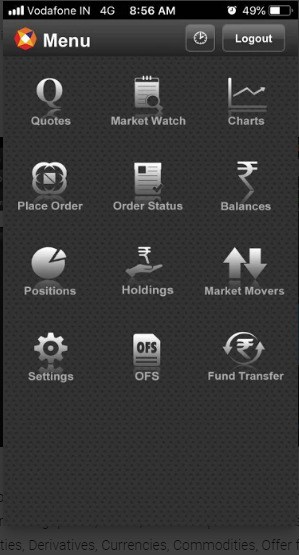

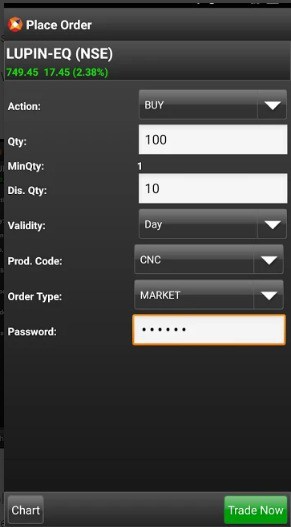

Mobile Trading Platform

Just Trade use NSE NOW as a mobile platform and mobile app is very user friendly as web trading platform

Advantages of NSE NOW Just Trade App

- User-friendly

- Good variety of order types

- Price alerts

Mobile App look

Alerts and Notifications

You cannot set price alerts on the NSE Now itself.

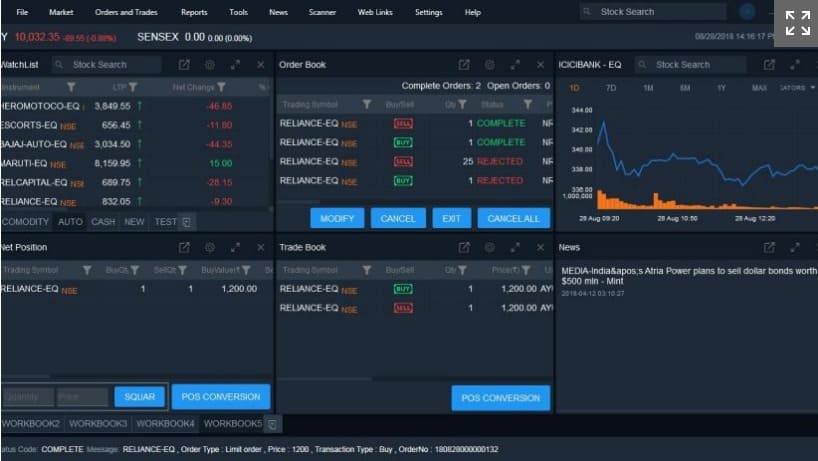

Desktop Trading Platform

Just Trade Securities provide Omnesys Nest Trading platform.

- All three trading exchanges NSE, BSE and MCX are enable in trading platform.

- One of the fastest trading platform.

- Advance charts with near about 65 technical indicators.

- Real time data with high speed.

- Easy to download and installed and use.

Trading platform look

Just Trade Securities Markets and products

Just Trade provides trading in various segments like Equity, currency, derivatives.

| Just Trade | |

|---|---|

| Stock | Yes |

| ETF | Yes |

| Currency | Yes |

| Funds | Yes |

| Bond | Yes |

| Options | Yes |

| Futures | Yes |

| Commodity | NO |

| Banking | NO |

| Insurance | YES |

Stocks, ETFs, Currency, Derivatives Available in Just Trades

- Two stock exchanges in enable in just trade NSE and BSE. Trader has option to choose stocks from two exchanges.

- There are near about 130 ETFs are available for trading.

- EURINR, USDINR, JPYINR, GBPINR currency futures are available for trading.

- Derivatives like Future, Options (Put & call) offer by just trade.

Wait! Looking for Best Demat Account

FREE Investing in Stocks & Mutual Funds with No 1 broker in India!!

+1 Crore Happy Customers

Zero Brokerage on Equity Delivery Trades

Flat ₹20 or 0.03% (whichever is lower) for Intraday and F&O

Trade with the best platforms and tools

Some Useful Services.

| Online Trade Reports. | YES. |

| Online PNL Reports. | YES. |

| Intraday Chart Facility. | 5 Days on ODIN & NOW. |

| End of Day Chart Facility. | 5 Years on ODIN & NOW. |

| 3 in 1 Account. | NO. |

| Charting | NO |

| Online Demo | YES |

| Online Portfolio | YES |

| Intraday Square-off Time | 3:15PM |

| NRI Trading | YES |

| SMS Alerts | YES |

| Algo Trading | NO |

| Instant Fund withdrawal. | NO. |

| Relationship Managers. | YES. |

Customer Care Details.

| Contact Details. | Register Office. Bajaj House,5th Floor, 97 Nehru Place. New Delhi -110019. |

| Call. | Customer Care. Toll Free: 1800-110-900. 1800-3000-9000. [Monday to Saturday 9 Am to 6 Pm IST]. Get Direct Access to Customer Care Centers Across India. |

| Email. | [email protected] / [email protected] |

| Complaints Or Grievances. | [email protected] |

Customer service

Customer reach out to just trade through e-mail, telephone and visit to nearest branch.

Advantages & Disadvantages

- Phone support

- Fast response time

- Relevant answers

- No live chat

- No 24/7 support

Safety at Just Trade Securities

Just Trade Securities is full service stock broker and regulated by Securities Exchange Board of India.

Is Just Trade Regulated?

Yes, it is regulated by the SEBI. Just Trade is based in India and it is backed by Bajaj Capital.

Is Just Trade Safe?

Yes, just trade is safe for trading and buying stocks, Derivatives and currency.

What is the Background of Just Trade?

Bajaj capital group company India’s leading Financial Planning and Investment Advisory Company from last so many years..

Just Trade Securities Review & Ratings

On the scale of 5 (0 is worst & 5 is best). Below are the review & rating for Just Trade Securities.

| Summary | Ratings |

|---|---|

| Customer Experience | 3.5 / 5 |

| Trading Platform / Mobile APP | 4 / 5 |

| Services | 4 / 5 |

| Brokerage Charges | 5 / 5 |

| Fund Add / Withdrawal | 4.5 / 5 |

| Overall Rating | 4 / 5 |

| Star Rating | ★★★★ |

| Review Counts | 120 |

Sebi Registration.

| CIN: U67120DL2004PLC130803. |

| SEBI Regn. Nos:NSE :INB/INF 231269334 | BSE: INB/INF 011269330; NSE Trading Member Code-12693 | BSE Clg No-6421. |

| Depository Participant: Bajaj Capital Limited.: CIN: U67120DL1965PLC004338 | SEBI Regn. No: IN-DP-NSDL-303237 DP ID: IN303237. |

More Useful Articles