IPO (Initial Public Offer) is a perfect way for companies to raise funds for expansions and enter a new business domain. The IPO process has eased a lot due to the Digital evolution and arrival of modern technology. Still, a lot of hard work and brain-storming goes in for releasing an IPO. The whole process of launching, allotment, and trading of IPO in the stock market is done under the strict vigil of SEBI (Securities and Exchange Boards India).

Lets Understand IPO Process in India

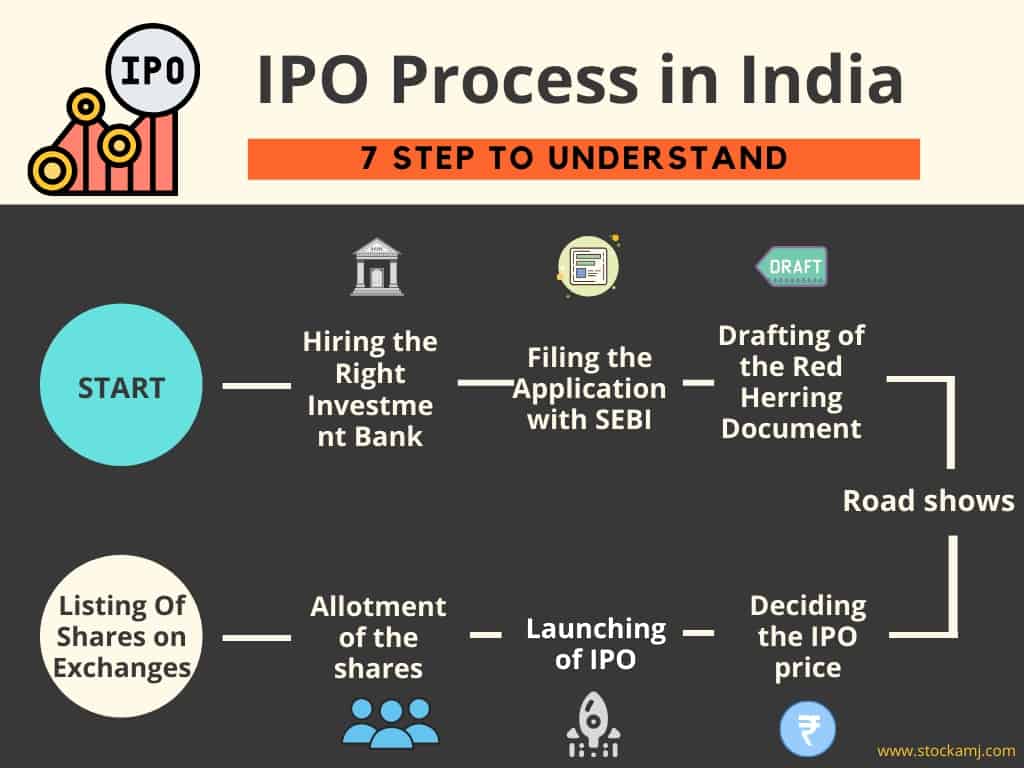

Let’s understand this whole process in 7 single steps. In this overview, you will learn about all the steps involved in the IPO process in India in detail.

To understand the process more efficiently, let’s assume a hypothetical company ASDF involved in the manufacturing of apparel. ASDF has two plants, one in Chandigarh and another in Surat, Gujarat. The business of ASDF is booming and hence the owners want to increase their manufacturing capability.

To do so, they want to erect a new plant in Bhilwara, Rajasthan. For this, they need a capital investment of around INR 600 crore. To raise the necessary fund, they decide to launch an IPO of their company.

Following are the steps they need to follow

1. Hiring the Right Investment Bank

An investment bank is an institution that will sign the underwriting for ASDF. But before signing it, the Investment bank will perform an extensive analysis of the financial situation of ASDF.

They will do a thorough checking of cash flow statements, Profit and Loss statements, Balance Sheet, and other relevant financial documents.

They will also help ASDF with the allocation of IPO to the different categories of the investors.

Many investment bankers like Karvy and HDFC securities offer such services. The sole purpose of such investment banks is to assist companies in raising maximum funds.

2. Filing the Application with SEBI

Investment Bank hired by the ASDF will prepare a detailed application with all the necessary documents. This application will be submitted to the SEBI.

SEBI will do a detailed checking of every financial and non-financial information before giving it’s nod. This is very crucial part of the IPO application process.

It’s vital to provide all the necessary information in correct format to avoid any rejection from SEBI.

This whole process is to be done by investment banks and hence it’s necessary to hire a right one!

3. Drafting of the Red Herring Document

In this step, an initial prospectus of the IPO is released with the estimated price of each share and other relevant details. This step is taken to ensure no price related issues arise during the actual launch of the IPO.

This step is called Red Herring as a clear warning is mentioned on the first page of the prospectus that this is not the final prospectus.

4. Road shows

Before the launching of IPO, a mega event is organized to advertise the IPO! Relevant ASDF executives and officers travel the length and breadth of the nation and advertise their IPO, especially to the QIBs.

The marketing is done by arranging various presentations to help investors better understand the positive aspects of the particular IPO.

5. Deciding the IPO price

In this step, price of the IPO is finalised. There are two ways of deciding the IPO rate. One is fixed price where the company decides some price and IPO is available at that price.

The other one is Book Building, where the exact IPO price is decided through the bidding process.

The numbers of share that will be allotted will also fixed by the ASDF. Request for the registration statement is also done to SEC during this step to facilitate the trading of shares.

6. Launching of IPO

Finally, on a fixed date, IPO launched to the people for application. Interested investors can make the application for subscription through online or off-line process.

As per the SEBI guidelines, the IPO is available to the public for 5 days for subscription.

Also Read: What is IPO Allotment Status in India?

7. Allotment of the shares

The allotment is done to the investors on the lottery system designed by SEBI. Investors who are allotted shares will get them credited in their Demat account on the day of listing. Investors who failed to get allotment will have their money unblocked. Once the shares are listed on the market, shares of ASDF are available for trading to anyone.

Note: If you want to learn more about IPO and how to apply for IPO, we can help you with that. Write to us for more details or write in below comment area.

More Article on IPO