Investments are made in a group of assets or securities instead of a signal asset, they are called a portfolio investments.

The aim of every trader is to invest with minimum risk and maximum profit. For this, you have to organize your portfolio and maintain it properly. It is also important to make necessary changes in the portfolio from time to time. It must to includes in portfolio financial investments such as stocks, fixed deposits, mutual funds.

9 Easy Ways To Select best shares for Good Portfolio Investments

The main reason for building a good portfolio is to provide financial stability to yourself and your family in the future. Below are the 9 ways to create best portfolio investments.

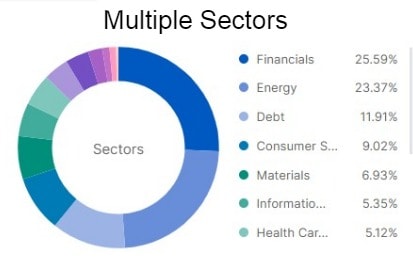

1. Determine the Sectors Before Buying Shares.

In the stock market, there are many companies listed on stock market from different industries. Every industry sector has some advantages and some disadvantages. Some industry sectors may be very profitable in the present, and some industries may be very profitable in the future, but there is huge possibility of any particular sectors give tremendous loss in future.

Before investing or buying any stock, choose a profitable industry sector.

2. Select Multiple Companies

The portfolio should consist of shares of ten to fifteen companies. Each company should be in a different sector.

It is always beneficial to have shares of different companies in the portfolio at least ten to twelve times. And all these companies should be related to different industries. Investing all the money in the same company or in the same industry sector can be a loss.

If you have invested in various sectors and suppose in the future, even if one sector loses for some reason, the other industries make up for the loss.

3. Limited Number of Companies from Each Sector

- The portfolio should not include all companies from same group. Example, Reliance group of companies, Tata group of companies, Birla group of companies.

- The portfolio should have a maximum of two companies in a group.

- A maximum of 2 companies from the same sector should be selected in the portfolio.

For example, if you are investing in the banking sector, choose the banks in India that are fundamentally strong (HDFC Bank, ICICI Bank).

4. Includes large-Cap, MID-Cap, Small-Cap

The portfolio should include a wide variety of stocks such as Bluechip, Defensive, Growth, Cyclicer. This diversifies the investment and reduces the risk.

5. Decide Time and Price

Determine the investment period of each stock as well as the expected price. In case of non-receipt of the desired price within the stipulated period, a policy should be decided to sell at a loss.

6. Rotation of Shares.

The portfolio should be reviewed. Make changes from time to time if necessary.

7. Take Time to Invest

Don’t invest the whole thing at once. An investment made in a planned and phased manner is always profitable.

8. Mutual Fund (SIP)

Some investors do not invest directly in stocks. But they find it easier to invest in mutual funds. This is because investors prefer to invest in all mutual funds if they do not know the stock market well and do not have time to study the stock market. As the value of the portfolio increases. As such, the unit price of mutual funds goes up.

Every mutual fund has a different investment scheme. Some mutual funds invest in stocks while some invest in government bonds. So some invest in both.

What is Mutual Fund?

- A mutual fund is a trust. (This trust is registered through the Charity Commission of Trust) This organization collects money from the people and invests this money in various securities. The investment was like the preaching of that scheme. In other words, mutual is a method of raising capital for the common man.

- A fund that invests only in government securities has stable earnings. Those funds invest in shares fluctuate in the price of their units.

Systematic Investment Plan

- The systematic plan is one of the most popular plans for the investment door. This is because you have to invest in it regularly at regular intervals. The investment in this scheme has to be made every one or three months. Generally, an initial investment of at least Rs 5,000 is required. And you have to pay Rs.1000 per month.

- Many companies offer the facility to buy shares on a specific day every month. This SIP method reduces the risk involved in investing.

9. liquidity

Look at the liquidity of the portfolio. You should be able to go out whenever you want.

Factors Influence portfolio Decision

- Investor characteristics

- Liqudity needs

- Tax considerations

- Safety of principle

- Assurance of income

- Investment risk

- Interest rate risk

- business and market risk

Also Read: How to Make Money from Stock Market?

Factors Affecting Portfolio Investments

- Age: It will define your financial priorities and what are your goals.

- Risk Tolerances: It will determine if and how much you can invest in risk assets

- Time Horizon: This aspect is related to fulfilling of specific specific financial goal and how much time left for their fulfillment.

More Useful Article