Discount Broker is a new concept introduces in India. A discount brokerage is a business that charges clients significantly lower fees than a traditional brokerage firm but without providing financial advice.

A stockbroker who provides service to its clients buy and sell stocks, commodities, the currency at a minimum brokerage as compared to a full-service broker, but he does not provide investment advice to its customers. It is a best option for those who are not interested in an advisory from a broker and wants to make a study on its own.

What is The Concept?

The new concept of “discount broker” has been in vogue among stock market traders for the past few years. Is the mediator in many exchange transactions? Intermediaries pay a fixed fee for this successful arbitration. This charge is called brokerage. These charges depend on the nature of the transaction.

What is Brokerage Charges?

Stock trading is done by brokers on behalf of investors. The broker has to be paid for the service of acting as an intermediary for the sale and purchase of these shares. It is called brokerage.

According to SEBI rules, a broker can recover a maximum of 2.5 per cent of the total purchase or sale value from the brokerage investor.

However, due to increasing competitiveness, the number of full-service brokers has come down to 0.1 per cent in some places, which is as low as 10 paise per 100 rupees. and discount stock broker charge only Rs.20 Per order.

Advantages

- Offers very low brokerage plan.

- Offers monthly brokerage plan, per trade plan, each segment plan. so u can select the best plan as per your requirement.

- Useful for intraday traders.

How Many Types of Brokerage Plans Available?

Brokers charging Fixed Price Per Trade.

These are the brokers who charge ‘fixed price brokerage per trade’ irrespective of the size of the trade.first The charges are also very low and vary from Rs 9 per trade to Rs 20 per trade.

Brokers charging Fixed Monthly Fees for unlimited Trades.

These are some discount brokers who charge ‘fixed monthly fees’ and offers unlimited trading in selected segments and exchanges.

The main discount brokers providing these services are RKSV and SAS online. They have a very competitive unlimited trading plan from Rs 999 to Rs 3999 depending on the exchange and services you need. You can read our detailed review about RKSV review and SAS online review.

India’s Top Discount Broker Comparison Chart.

| Broker Name | Broker Type | Account Opening Charge | Equity Delivery | Equity Intraday | Minimum Brokerage | Open Account Now |

|---|---|---|---|---|---|---|

| Trade Smart Online | Discount-Broker | Rs.400 | Rs.15 | Rs.15 Per Order | NIL | |

| Zerodha | Discount-Broker | Rs.300 | Rs.0 | Rs.20 Per Order | NIL | |

| Upstox | Discount-Broker | Rs.250 | Rs.0 | Rs.20 Per Order | NIL |

India’s Top Discount Brokers.

In India, Zerodha, Upstox are the leading discount brokers. One of these brokers announced that it would charge zero brokerage on non-selling deals on the same day.

This brokerage firm charges only Rs. 20 for a single transaction sold in the morning before the market closes, but before you can become a client, you no need to be tech expert.

Save Upto 90% on Brokerage Fee

stockamj recommend top brokers to open demat and trading account in India.

How Discount Stock Broker System Works?

- When trading in the stock market, the Bombay Stock Exchange or the National Stock Exchange allows its members to be connected to their computer system to conduct online trading of shares.

- These members allow access to the market’s computer systems through their computer network.

- They charge their customers, the investors, for the transaction. This fee depends on the type of market forum.

- There are three groups of transactions in the market. Cash transactions, derivatives transactions and option transactions are traded in three groups respectively.

- The brokerage charged for these three groups is different.

Why are They so Popular among s Traders Community?

- Discount brokers are brokers that charge less than traditional brokerage firms. They do not offer the additional services that traditional firms offer, so they can afford to charge less.

- Six years ago a brokerage firm Founded a company with the new concept of “discounted broking” With just a few employees but they handels more than 50,000 customers and transacting Rs 5,000 crore daily.

- Twenty-five per cent of the total market transactions are done by the customers of the top four discount bookers.

- Although this concept is not new in the world, it is a reflection of the changes that are taking place in the international stock market.

Why Discount Stock Brokers offer Low Brokerage Charges?

- Discount brokers do not offer any facility such as sending a research report from a traditional broker on the day of transaction or sending an SMS about buying or selling a share throughout the day.

- This is a facility for traders who do it on their own or voluntarily. In short, it is important to have a broker who can serve you as you need. So it is important to know your needs before taking the services of discount brokers.

- Machines are cheaper than human labor.

- This is because the concept of discount broking goes completely without human intervention. That’s why it’s so cheap.

Algo Trading in Discount Stock Broker

Algo trading is a technique of buying and selling fast according to the fluctuations of the stock price. Algo Trading is characterized by low profit but accurate to large profit or loss.

Some of these “Discount Brokers” have hired computer experts to write cods for Algo trading.

Some brokers have ready-made tested algo strategies and the customer is expected to adopt a suitable policy and trade accordingly.

How Discount Broker is Different from others?

In Discount Broker

Lets assume that Mr. Ramesh use Zerodha discount broker for trading.

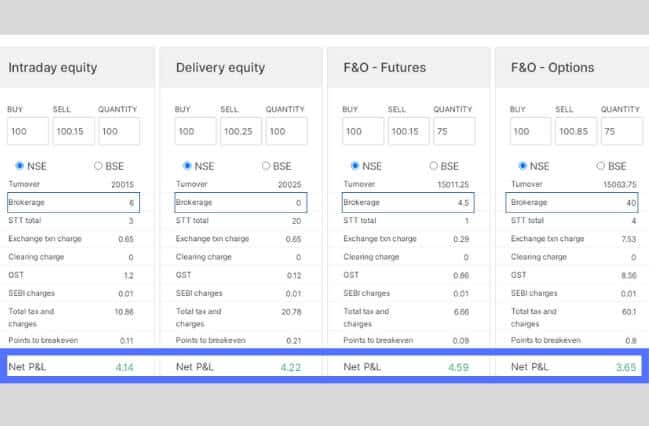

For Example: Suppose Mr. Ramesh Buy 100 shares of XYZ company at Rs.100 and Sell same number of shares at Rs.100.15 in intraday market than also Mr.Ramesh can earn profit of Rs. 4.14 after deduction of all taxes and brokerage charges.

Pls Refer below image for Zerodha Brokerage calculation, Point break-even and profit for each and every segments

In contrast, a full-service broker.

Lets assume that Mr.Ramesh use full service broker and pay 0.10% and 0.50% brokerage charges for Intraday & Delivery trading.

For Example: Suppose Mr. Ramesh Buy 100 shares of XYZ company at Rs.100 and Sell same number of shares at Rs.100.15 in intraday market than also Mr.Ramesh make loss of Rs. 8 Approx. after deduction of all taxes and brokerage charges.

Should I go For a Discount Broker

Many senior investors still call the broker after seeing the price on the television screen and demand to buy a certain number of shares at this price. This is not a service for such investors but it is a great tool for fast buying and selling traders.

Note: Setting up an online transaction requires verification of your identity through mobile or telephone.