Pandemic of covid-19 have impacted very badly on whole world. The pandemic has also affected the global economy and the domestic stock market. In March 2020, the stock market reached the bottom. From April, the stock market start to recover from this fall and within nine months, the market began to rise again. But again the second wave of corona start to haunt India. Once again, the stock market is swayed by waves of uncertainty.

Although uncertainty is the stability of the stock market, the fall in times of uncertainty is what really helps the market to consolidate, and when the uncertainty is over, the market bounces twice as fast. This is history. For example, the ten years after the Great Depression of 2008-09, 2009-2019, brought a hurricane to the United States.

What is Gold Funds?

Gold Mutual Funds allows you to buy gold in instalments and its value is displayed in the NAV. So instead of investing in grams of gold, you invest in rupees in mutual funds, whereas gold ETFs generally allow a minimum investment of 1 gram of gold.

Benefits of Gold Funds

Aside from the use of jewellery, there are many benefits to investing in gold funds without actually investing in gold. Some of them are as follows.

- The purpose of diversification in investment is achieved.

- The fall in the stock market during a recession reduces the value of your investment. In such cases, Gold Funds act as a protective shield.

- Erosion, risk, insecurity which have to be considered while handling or storing actual gold; It doesn’t have to be here.

- Options for growth & Dividend, SIP or Lumpsum

- Potential for higher returns return through active management.

- You can invest from a very small amount. (Minimum Rs.5000 at first and multiples of Rs.1000 thereafter) You can also invest in it through SIP like 500 / -.

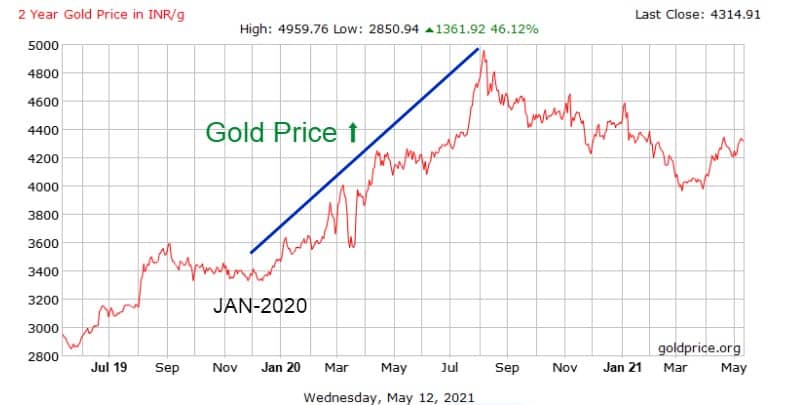

Gold Funds Returns in 2020

Any crisis has a ray of hope. Similarly, in the world of investment, there is always a hope for investors in times of recession, and that is investing in gold. Needless to say, Indians are fascinated by gold. But the attraction is to use it to make gold jewelry. Not as an investment tool. However, given the huge return of 26% on average by gold funds to investors in 2020 as the corona stock market falling everywhere, it looks like the golden days will come for investing in gold and alternatively gold funds.

See the attractive returns given by various gold funds in the last one year in the following chart.

| Fund Name | 1 Year Return |

|---|---|

| Axis Gold Fund | 22% |

| SBI Gold Fund | 26% |

| HDFC Gold Fund | 22% |

| Kotak Gold Fund | 25% |

| IDBI Gold Fund | 22% |

| Invesco India Gold Fund | 23% |

| Reliance Gold Savings Fund | 22% |

| Aditya Birla Sun Life Gold Fund | 23% |

| ICICI Prudential Regular Gold Savings Fund | 25% |

Gold ETF

Gold ETF (exchange trading fund) is an open-ended fund that trades on stock exchanges. It is a device based on the price of gold on investment in gold. Gold ETFs invest in gold of 99.5% purity (banks approved by RBI). They are managed by fund managers who track gold prices daily and trade physical gold to optimize returns. Gold ETFs provide high liquidity for both buyers and sellers.

Gold ETFs are registered on the stock exchange (NSE) and their units are traded on the stock exchange just like the shares.

Gold Funds Vs Gold ETF

Gold Mutual Funds When we consider, there are two types. Understand the basic differences between the Gold Fund and Gold ETF- (Gold-Exchange Traded Fund). Gold ETFs are 99.5 per cent of their investments in pure gold mining, processing, fabrication and distribution companies. Invest in their shares. Therefore, the return in Gold Fund is a bit higher than Gold ETF.

Differences Between Gold Funds & Gold ETF

| Gold Funds | Gold ETF |

|---|---|

| Easy to invest. You can invest in gold mutual funds directly through online mode or its distributors | Demat account is must. |

| Gold mutual funds allow investors to invest through SIP | SIP not allowed |

| Installments allowed and its value is displayed in the NAV | Gold ETFs generally allow a minimum investment of 1 gram of gold |

Conclusion

Now the important question is whether this is the right time to invest in gold or gold funds? According to experts, the depreciation of the rupee, small savings, falling interest rates on investments and volatility in the market due to the second wave of Covid-19 could lead to a rebound in gold and a good return on investment.

Take a Look