5paisa Review:

5paisa Capital is the full-service discount online brokerage part of 5paisa capital ltd. Publicly traded online brokerage (Symbol NSE: 5PAISA, BSE: 540776), services over 125000+ customers accounts and process over 15000+ Crores daily turnover. 5paisa is one of India’s Top 20 stockbroker with active customers.

Founded in 2006, 5paisa is a trusted brand with which most customers are happy. The Full-service discount broker is currently operating 400+ Cr market capitalization and it is the only discount broking company in the public sector and provides services in all segments like stocks, options, and futures trading. They also offer investment option in Mutual fund also.

5paisa Capital charges a flat fee of Rs.10 per executed order for Equity, F&O, and Currency derivatives, and is highly recommended for its quality customer care services, Trading platform etc.

5Paisa Introduction

| Incorporation Year | 2005 |

| Broker Services | Full-service Discount Broker |

| Website URL | www.5paisa.com |

| Contact Number | +91 8976689766 |

| Exchanges Accessible | NSE, BSE, MCX-SX |

| Demat (NSDL/CDSL) | CDSL |

| Active Total Client | 10000+ Clients |

5paisa Review for Brokerage Charges, Commission & Fees

Unlike its competitors, 5paisa Capital offers a simple, flat-free per order trading brokerage structure. Equity trades are just Rs.10 per order and Equity options trades run at Rs.10 and same for currency derivatives. Brokerage charges are very less as compare to other popular discount brokers.

5paisa better performed its discount broker competition with its offering tools, quality research and educational blogs and articles. The mutual fund is another high point. 5paisa Capital offers all available mutual funds for investments with low commission.

B

Compared to other discount-service brokers, 5paisa is cheaper than its two primary competitors, Zerodha and Upstox, which both charges Rs.20 per executed order. However, In 2016 5paisa initiated a brokerage charges war, resulting in all top full service largest brokers in India cutting commission rate across all products.

| Plan Subscription Summery | 5paisa charge only a flat fee of Rs.10 per order. All segments including equity, Equity Derivatives (F&O) and Currency. |

| Equity Intraday Charges | Rs.10 per executed order. |

| Equity Delivery Charges | Rs.10 per executed order. |

| Equity Futures Charges | Rs.10 per executed order. |

| Equity Options Charges | Rs.10 per executed order. |

| Currency Futures Charges | Rs.10 per executed order. |

| Currency Options Charges | Rs.10 per executed order. |

| Commodity Charges | NA |

| Minimum Brokerage Fees | Flat Charges Rs.10 |

| Any Hidden Cost | No, ✖ |

| Call & Trade Charges | Rs.100 /per call(No order limit). |

As the lowest online discount broker in India, 5paisa provides greater value for their customers beyonds low-cost brokerage. For Example, 5paisa offers investment advisory, news, alerts, etc while another discount broker only focuses on low brokerage.

Bottom Line, in terms of brokerage charges, 5paisa currently holds the crown of

Available Brokerage Plans

- Monthly Subscription: Not Available.

- Yearly Subscription: Not Available.

- Multiple Subscription: Not Available.

Margin/Leverage

Unlike other platforms, 5paisa provides short-selling with up to three- twelve-time intra-day margin and up-to three and a half on overnights. This is so risky in intraday trading so precaution must be taken with any short-selling positions. Every trader must to maintained Net account balances to avoid automatic forced sq.off margin calls. This means 5paisa will sq.off your position immediately if your net account balance drop to a certain level. You must check the minimum stock maintenance margin requirements.

| Margins or Leverage | 5paisa.com |

| Equity Margin Intraday | Up to 3 to 12 times for equity cash. |

| Equity Margin Delivery | Up to 3.5 times for equity delivery. |

| Equity Margin Futures | Upto 2 times for futures. |

| Equity Margin Options | No margin for option buyers. |

| Currency Margin Futures | Up to 2 Times for Intraday. |

| Currency Margin Options | Up to 2 Times for Intraday. |

| Commodity Margin | NA |

Wait! Looking for Best Demat Account

FREE Investing in Stocks & Mutual Funds with No 1 broker in India!!

+1 Crore Happy Customers

Zero Brokerage on Equity Delivery Trades

Flat ₹20 or 0.03% (whichever is lower) for Intraday and F&O

Trade with the best platforms and tools

Account Opening Fees and AMC charges

| Trading Account Opening Charges | Rs. 650 |

| Trading Annual Maintenance Charges | Free |

| Demat Account Opening Fees | Free |

| Demat Annual Maintenance Charges | Free 1st Year (Rs.400/Per Annum) |

| Commodity Fees | Rs.0 |

| Offer DP Service | Yes, Available ✔ |

Trust

5paisa has been in business for more than 12 years and has received industry accreditation for its trading platform, investment offerings, and trading tools, Customer support, Customer complaints management.

- 17000 Cr.+ Daily Turnover: Fastest growing online stock broker in India

- 175000+ Clients: Positioned among Top 20 broker in active customers

- 400 Cr+ Capitalization: Only discount broker in India Listed as a public limited.

- Awards: Awarded as the Emerging Brand Excellence in BFSI of the year 2018.

- 2 Million App Downloads: Fast to reach this milestone in the discounted brokerage of India.

- 500 Cr+Assets Management: A trusted brand for bringing value to your investments.

5paisa Review for Transparency & Other Fees

| Equity Day Trading | 0.00325% or Rs.325/per crore. |

| Equity Delivery | 0.00325% or Rs.325/per crore. |

| Equity Futures Trading | 0.0019% or Rs.190/per crore. |

| Equity Options Trading | 0.05% or Rs.5000/per crore. |

| Currency Futures Trading | 0.0011% or Rs.110/per crore. |

| Currency Options Trading | 0.04% or Rs.4000/per crore. |

| Commodities Trading | NA |

| AMC Charge | Rs.400/- (1st year Free). |

| DP Transaction Fees | Rs.25/per transaction. |

| Offline order placing Charge | Rs.100 /per call(No order limit). |

| Sebi Charges | Rs.15/per cr. |

| GST | 18% on Brokerage + Transaction charges. |

| Stamp Duty | As per Clients state. |

Usability of Services

In this section, we conduct quite a big area. From experiences of logging in to websites and its navigating structures, order placing, execution of trade, research, and analysis reports, Account Preferences Management, This is about the whole experience.

For account management, 5paisa id very good. Year ending tax (profit & loss) reporting is very easy, and account ledgers balance statements are just click away.

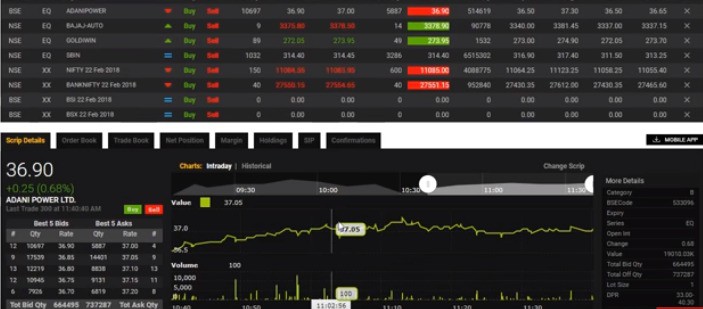

In the case of trading, successfully, all 5paisa Investment customers are smoothly login to Live Responsive trading website. Live Streaming quotes are easily visible, and trade can be placed easily by clicking on selected scrips using left side 5paisa Tradestation tools. Website trading portals have a fully customizable home screen and it is familiar with all the version of browsers.

While clients will easily feels very familier with LIVE portal, One reason why 5paisa all new customers directly on the trading portal. Directly and directly more user-friendly than previous experience.

Similarly, if customer want to trade futures or fores derivatives, customer will directl acess same portal for the same. Considering that forex and currency futures trading in the india are not common currently, but still 5PAISA TRADESTATION has full trading capabilities in trading.

Reporting

| Trade Online Reports | Yes, Available ✔ |

| PNL Online Reports | Yes, Available ✔ |

| Online Contract Notes | Yes, Available ✔ |

Trading Platforms & Tools

As previously mention in the above Usability od services catergory, 5paisa TradeStation provides a very good and clean mobile experience and desktop. Once you logging in, you will be automatically move to Home screen, which includes a clean and beatiful looking style tiles. The Home screen offers a quick and simple trading windows to manage your portfolio.

| Trading Platforms / Software | 5paisa.com |

| Desktop Trading Platform | 5PaisaTradeStation |

| Web Based | www.5paisa.com << Trade |

5paisa, like its competitors, provides tools and trader services for active customers, including TRADESTATION, which is both desktop and web based. Like Zerodha, all platforms are available to all clients, no matter of account balance minimums or trading activity.

During our experimental testing of trading platform, we found that charting features is very excellent. Viewing daily or intraday stock charts (1min, 5 min, 15 min etc), modifying settings, and adding technical indicators, drawing on charts, performing the technical analysis is an amusing experience. so many different drawing tools are available as well as more than 80 technical indicators.

| Desktop Platform (Windows) | Yes, Available |

| Charting – Indicators / Studies | 166 |

| Charting – Drawing Tools | 22 |

| Option Chains – Total Columns | 26 |

| Watch Lists – Total Fields | 91 |

Charts and Indicators

The real-time candlestick, bar and line charts can be set from 1-minute up to 1-hours time frames going back over five-years. Price and momentum indicators ranging from exponential, simple, weighted moving averages, Bollinger Bands to money flow index, MACD and RSI oscillators help improve price action pretention.

| Intraday (Day Chart) | Yes, Available ✔ |

| End of Day (Daily Chart) | Yes, Available ✔ |

| Coding/Backtesting | No, ✖ |

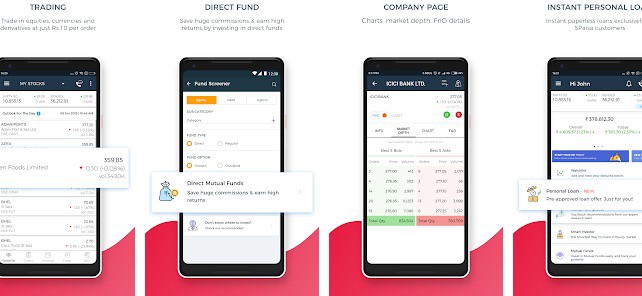

Mobile Trading Application

5paisa mobile trading includes

“5paisa mobile experience is cleanly designed, bug-free, and delivers a phenomenal experience for investors.”

Focusing on the mobile app’s 5paisa give very good experience and better functionality and it is bug-free mobile app include all required to manage investment portfolio easily. Customer can view portfolio holdings, customizable market watch lists, you can pull stock quotes, stock charts analyzing, more than 25 indicators are available, all with live real-time streaming data. Placing trades using mobile app is very simple process.

Short summery of trading platform details with demo links.

| Demo (Desktop) Platform | Demo |

| Windows Desktop platform | Yes, Available ✔ |

| MAC Desktop platform | No, ✖ |

| Web Trading URL | Yes, Available ✔ |

| Web Trading Portals Info | Available on 5paisa home page. |

| Mobile Site | Yes, Available ✔ |

| Mobile Trading Availability | Yes, Available ✔ |

| Mobile Trading Application | Yes, Available ✔ |

| Mobile App Demo | Yes, Available ✔ |

| Android / Ios Mobile App | Yes, ✔ Both Avilable |

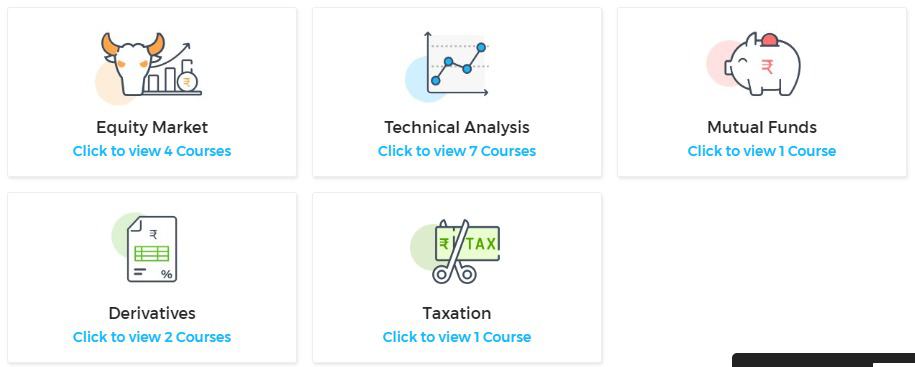

Education

5paisa has done great work to teach new beginners of

Support and Tools

| Research & Tips | Yes, Available ✔ |

| Brokerage Calculator | No, ✖ |

| Span Margin Calculator | Yes, Available ✔ |

| Trailing Stoploss | No, ✖ |

| Training & Education | Yes, ✔ Blogs, Articles |

5paisa Review for Useful Trading Features

| 3 in 1 Account (Bank+Trading+Demat) | No, ✖ |

| Instant Fund withdrawal | No, ✖ |

| Relationship Managers (RM) | No, ✖ |

| Charts | Yes, Available ✔ |

| Algo Trading / Robot | No, ✖ |

| Mobile SMS Alerts | Yes, Available ✔ |

| Online Demo | Yes, Available ✔ |

| Online Portfolio | No, ✖ |

| Margin for Future Trading | Yes, Available ✔ |

| Combined Records for Equity & Commodity | No, ✖ |

| Intraday Sq.off Timing | 3.10 PM |

| Can NRI Trade | Yes, Available ✔ |

| Extra Features | Ask to Broker |

Investment Service and Available Options

| Equity Cash & Future & Option | Yes, Available ✔ |

| Currency Derivatives (Forex) | Yes, Available ✔ |

| Commodity | No, ✖ |

| Online IPO Request | No, ✖ |

| Mutual Funds (MF) | Yes, Available ✔ |

| Bonds / Negotiable Certificate of Deposit | Yes, Available ✔ |

| Exchange-Traded Fund (ETF) | Yes, Available ✔ |

| Banking Services | No, ✖ |

| Direct Insurance | Yes, Available ✔ |

| Forex Investment | No, ✖ |

| MF SIP Investments | Yes, Available ✔ |

| PMS Services | Yes, Available ✔ |

| Other Options | Ask to Broker |

Banking at 5paisa: Fund Add/Withdrawal Process

- Fund Pay In and Payout: Add Fund by Cheque, Online Bank TraNsfer using IMPS, NEFT or RTGS, UPI, Net-Banking and payment gateway. Withdrawal fund by Bank Transfer

- Time for Payout: 24 hours (working days).

- Linked Bank: Near about 23 banks available for fund credit and Rs.9 for per transaction.

Trading Order Types

| Cash N Carry (CNC Order) | Yes, Available ✔ |

| Margin Intraday Square (MIS Order) | Yes, Available ✔ |

| Normal (NRML Order) | Yes, Available ✔ |

| Cover Order | Yes, Available ✔ |

| Bracket Order | Yes, Available ✔ |

| Buy Today Sell Tomorrow (BTST) | No Information |

| Sell Today Buy Tomorrow (STBT) | No Information |

| AMO -After Market Order | No, ✖ |

| GTG-Good Till Cancelled | Yes, Available ✔ |

Investment Advice -Tips, Research & Reports

| Equity Research | Yes, Available ✔ |

| Mutual Fund Research | No Info |

| ETF Research | No, ✖ |

| Daily Report | Yes, Available ✔ |

| Free Tips-Advisory | Yes, Available ✔ |

| Company Result Analysis | Yes, Available ✔ |

| News & Alerts | Yes, Available ✔ |

5paisa Review for Customer Care Services

Discount brokers are able to offer lower brokerage charges and trading commissions than full-service brokers because discount broker only

One thing that 5paisa offers excellent customer care support. Head office located in Mumbai and they operate from Mumbai only. customer support is just a short drive away. Of course, it also offers support by phone, plus email, and text. Interestingly, it even offers customer complaints support by Compliance Officer (Mr.Nirav Shah, 8976689766, [email protected])

| Customer Care Service 24/7 | No, ✖ |

| Email Support | Yes, Available ✔ |

| Live Chat Online | No, ✖ |

| Phone Support | Yes, Available ✔ |

| Toll-Free Number | No, ✖ |

| Support by Branch | No, ✖ |

| Customer Care Contact Number | 8976689766 |

| Account Opening Procedure | Paperless |

| Customer Support Email | [email protected] |

| Complaints Support Email | [email protected] [email protected] [email protected] |

| Educational Blog | Yes, Available ✔ |

| Head Office Address | Sun Infotech Park, Road No. 16V, Plot No.B-23, Industrial Area, Wagle Estate, |

5paisa Review & Rating

On the scale of 5 (0 is worst & 5 is best). Below are the review & rating for 5paisa Capital.

| Summary | Ratings |

|---|---|

| Customer Experience | 4.5 / 5 |

| Trading Platform / Mobile APP | 4.9 / 5 |

| Services | 4.5 / 5 |

| Brokerage Charges | 5 / 5 |

| Fund Add / Withdrawal | 5 / 5 |

| Overall Rating | 4.7 / 5 |

| Star Rating | ★★★★★ |

| Review Counts | 845 |

Sebi Registration

- SEBI Registration Number : INZ000010231

- SEBI RA Regn.: INH000004680, IN-DP-192-2016

- AMFI REGN No.: ARN-104096

- SEBI RA Regn.: INH000004680, IN-DP-192-2016

- CIN : L67190MH2007PLC289249

- NSE Member ID : 14300

- BSE Clg No : 6363

5paisa Frequently Asked Questions

What Is Intraday Brokerage charges In 5Paisa Capital?

5Paisa charges Rs.20 per order for all segments like Stocks, Commodity & Currency.

How Many People Using 5Paisa Capital?

5Paisa has More than 9,00,000+ active customer.

What Are Annual Maintenance Charges For Equity, Commodity, Currency And F&O In 5Paisa Capital?

5Paisa charged Rs.0 for Trading & Rs. 540 per yearly for Demat Annual Maintenance Charges.

What Are Account Opening Charges For Equity, Commodity, Currency And FNO In 5Paisa Capital?

Rs.300 of trading & Rs.0 Demat account opening charges.

Does 5Paisa Capital Provide 3 In 1 Account?

No, 5Paisa is a discount full-service stock broker & offer only offer Trading + Demat account.

Is Any Screener Available in 5Paisa Capital?

Currently 5Paisa Capital do not offer screener.

Is Algo Trading Facility Is Available With 5Paisa Capital?

Yes, Algo trading facility now available with 5Paisa.

Data Analysis Is Available With 5Paisa Capital?

Yes, 5paisa provides analysis market data with also trading platforms.

How Many Days Are Required To Credit Fund Into My Account In 5Paisa Capital?

Fund withdrawal usually takes 1 working day to credit fund.

Does Investment In Mutual Funds Allowed & charges In 5Paisa Capital?

Mutual funds investments are allowed in 5Paisa & Rs.0 brokerage charges for MF investments.

Does 5Paisa Capital provide Research & Advisory, Tips?

Yes, 5paisa is full-service broker & they offer Research, Advisory.

Do i Apply IPO Through 5Paisa Capital?

Yes, Customer can apply IPO in 5Paisa Capital and IPO application process is very easy.

Take A Look