Ashlar Online is part an Ashlar Group. Ashlar Online provides services in Equity, Commodities, Currency, Depository Participant(DP), IPO’s, Life Insurance, General Insurance, Corporate FD’s, Bonds, Distribution, INSURANCE DEMAT. Member of NSE, BSE, MCX, NCDEX, NSDL since 2010.

Ashlar Online has more than 4000+ active clients. Head Office Located in Noida.

Advantages of Ashlar Online.

- They offer service at your doorstep to reduce your work.

- One of the lower charges as compared to other stock brokers.

- No need to pay anything for Account Opening. Just Free account opening.

- Each and every customer get dedicated relationship manager.

- Customer can customzed product as per requirment.

- Both Online and offline trading platform available.

| Website. | www.ashlarindia.in |

| Demat Account. | NSDL |

| Trading Exchanges. | NSE, BSE, MCX, MCX-SX, NCDEX, |

| Broker Type. | Discount Broker. |

Ashlar Online Account Opening Fees.

| Trading Account. | Rs. 0 |

| Demat account. | Rs. 0 |

| Commodity Account. | Rs. 0 |

| Trading Annual maintenance charges (AMC). | 999 + 14% Service Tax |

Note:

- Rs 17 per debit instruction for DP Transaction Charge

- Offline order placing Charge is only Rs 9 per executed order.

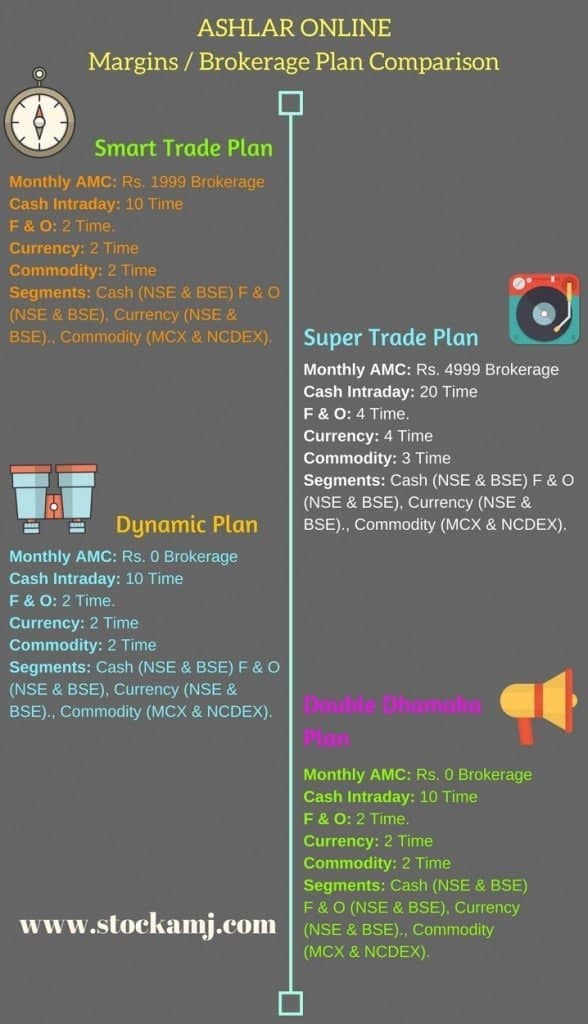

Ashlar Online Brokerage Charges & Margins.

1) DYNAMIC PLAN: Rs. 10 per Executed order (Traded order).

Features.

- A plan is available for all segments: Equity, Commodity & Currency.

- No turnover limitation.

- 10-time exposure on margin in Cash Market (NSE & BSE).

- 2-time exposure on margin in Equity-Derivatives (NSE & BSE).

- 2-time exposure on margin in Currency-Derivatives (NSE & BSE).

- 2-time exposure on margin in Commodity Futures (MCX & NCDEX).

- Free Online Trading Software, Single Trading Platform for all Segments.

- Govt. Charges, Exchange Charges & other statutory charges will be charged extra.

- Carry forward Limit will be as per Regulatory & Exchanges Rules & By-Laws.

- Online Payout Facility.

2) SMART TRADE PLAN: Unlimited Trading @ Zero Brokerage across all segments.

Features.

- For A flat monthly fee of Rs. 1,999 as Account Maintenance Charges for each segment, trade in securities with NSE (Cash, F&O & CDS), BSE (Cash, F&O & CDS) & in commodities [MCX & NCDEX Futures].

- 10-time exposure on margin in Cash Market (NSE & BSE).

- 2-time exposure on margin in Equity-Derivatives (NSE & BSE).

- 2-time exposure on margin in Currency-Derivatives (NSE & BSE).

- 2-time exposure on margin in Commodity Futures (MCX & NCDEX).

- Free Online Trading Software, Single Trading Platform for all Segments.

- Govt. Charges, Exchange Charges & other statutory charges will be charged extra.

- Carry forward Limit will be as per Regulatory & Exchanges Rules & By-Laws.

- Online Payout Facility.

3) SUPER TRADE PLAN: Unlimited Trading @ Zero Brokerage across all segments.

Features.

- For A flat monthly fee of Rs. 4,999 as Account Maintenance Charges for each segment, trade in securities with NSE (Cash, F&O & CDS), BSE (Cash, F&O & CDS) & in commodities [MCX & NCDEX Futures].

- 20-time exposure on margin in Cash Market (NSE & BSE).

- 4-time exposure on margin in Equity-Derivatives (NSE & BSE).

- 4-time exposure on margin in Currency-Derivatives (NSE & BSE).

- 3-time exposure on margin in Commodity Futures (MCX & NCDEX).

- Free Online Trading Software, Single Trading Platform for all Segments.

- Govt. Charges, Exchange Charges & other statutory charges will be charged extra.

- Carry forward Limit will be as per Regulatory & Exchanges Rules & By-Laws.

- Online Payout Facility.

4) DOUBLE DHAMAKA PLAN: Pay minimum amount Just Rs. 1000 for Account Maintenance Charges.

Features.

- Rs. 1000 brokerage will be add-on by the company.

- No Turnover Limitations.

- Applicable per segment (Equity/Commodity/Currency).

- 10-time exposure on margin in Cash Market (NSE & BSE).

- 2-time exposure on margin in Equity-Derivatives (NSE & BSE).

- 2-time exposure on margin in Currency-Derivatives (NSE & BSE).

- 2-time exposure on margin in Commodity Futures (MCX & NCDEX).

- Plan Validity one month only.

- Online Payout Facility.

- Default Brokerage should 0.01% for intraday & Futures, 0.10% for Delivery & options brokerage 40/lot.

- Free Online Trading Software, Single Trading Platform for all Segments.

- Govt. Charges, Exchange Charges & other statutory charges will be charged extra.

Ashlar Online Margins / Brokerage Plan Comparison Table.

Trading Platforms or Software.

| Trading Platform or Software. | YES. |

| Web-based. | Comfort Online Trading |

| Mobile Application. | No Info. |

Some Useful Services and Fund Transfer.

More than 19 major Banks are available for ashlar online fund transfer and withdraw. Charges for fund transfer is only Rs. 6 per transaction.

| Online Trade Reports. | YES. |

| Online PNL Reports. | YES. |

| Intraday Chart Facility. | 5 days on ODIN. |

| End of Day Chart Facility. | 5 Years on ODIN. |

| 3 in 1 Account. | NO. |

| Instant Fund Transfer or Withdrawal. | NO. |

| Relationship Managers. | YES. |

| Brokerage Calculator. | YES, Available. |

| Margin Calculator. | No. |

Turnover charges.

| Equity Trading. | 0.00325% of Turnover |

| Futures Trading. | 0.0029% of Turnover |

| Options Trading. | 0.0065% of Turnover |

| Commodities Trading. | 0.0025% of Turnover |

Wait! Looking for Best Demat Account

FREE Investing in Stocks & Mutual Funds with No 1 broker in India!!

+1 Crore Happy Customers

Zero Brokerage on Equity Delivery Trades

Flat ₹20 or 0.03% (whichever is lower) for Intraday and F&O

Trade with the best platforms and tools

Customer Care.

| Contact Details. | Processing Office. 1008, Street No 2, Arjun Nagar, Gurgaon-122001 Corporate Office. 411, Arunachal Bhawan, 19, Barakhamba Road, New Delhi-110001. Phone No: 011-47464740. |

| Call. | Customer Care. Tel No: 08802822222. |

| Email. | [email protected] |

| Complaints or Grievances. | [email protected] |

Ashlar Online Review & Ratings

On the scale of 5 (0 is worst & 5 is best). Below are the review & rating for Ashlar Online

| Summary | Ratings |

|---|---|

| Customer Experience | 3.5 / 5 |

| Trading Platform / Mobile APP | 4 / 5 |

| Services | 4 / 5 |

| Brokerage Charges | 5 / 5 |

| Fund Add / Withdrawal | 4.5 / 5 |

| Overall Rating | 4 / 5 |

| Star Rating | ★★★★ |

| Review Counts | 912 |

More Useful Article